Over a third (38%) of people in permanent credit to their energy firms live in households with low incomes and may have cut back on energy use or other essentials because the direct debits set by energy firms are far too high. [1]

The new research from the Warm This Winter campaign has been published as over 12,000 bill payers are set to take action to claim back energy credit in protest at Britain’s broken energy system. [2]

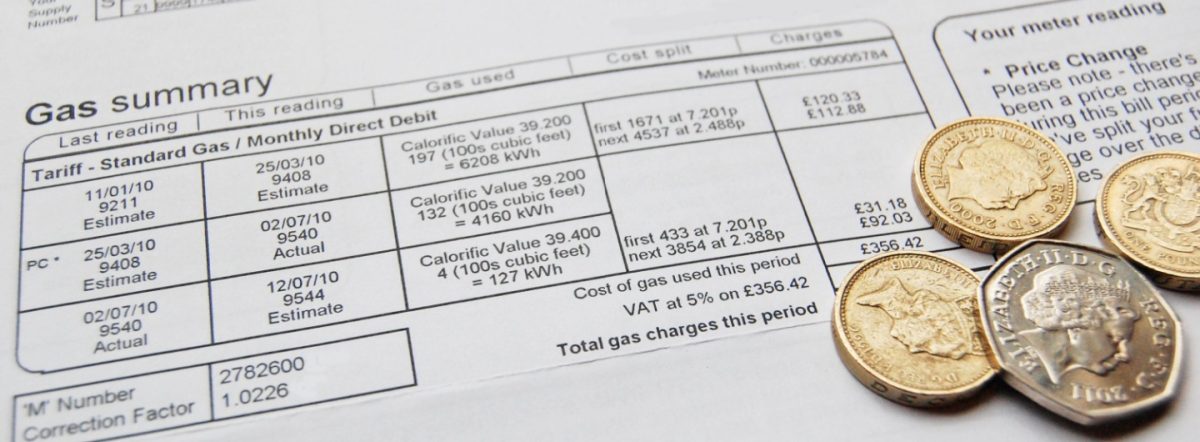

Currently UK energy suppliers are sitting on over £3bn worth of customer credit, with nearly a third of UK households (32%) in the black to their energy supplier all year.

New figures suggest that the combined bank interest likely to have been earned on customer credit balances was at least £159m in 2023 alone. [3]

Campaigners from 38 Degrees and Warm This Winter have now launched a “Big Energy Credit Claim Back” drive as the early summer is the ideal time to reset energy bill direct debit payments for the year ahead.

The campaign will make clear that customers should not cancel their direct debits though as this could lead to higher unit costs being imposed on households. It also warns that claiming back credit could lead to higher direct debit payments this summer.

A spokesperson for the End Fuel Poverty Coalition, commented:

“Experts have recently pointed out that while it is sensible to build up credit in the summer months to pay for higher energy use in the winter, customer credit balances have become too high.

“It’s highly concerning that low income households may have been charged too much on their direct debits leaving them to struggle to make ends meet during the cost of living crisis.

“With the huge sums being earned in interest by the energy firms, the least they can do is make sure that credit balances are not running too high, direct debits are set appropriately and the interest they have earned is either paid back to consumers or used to cancel energy debt of those most in need.”

Warm This Winter spokesperson Fiona Waters said:

“Energy companies are sitting on over £3 billion of bill payers’ money whilst providing an appalling service in many cases and making billions in profits.

“The Big Energy Claim Back is a way people who pay by direct debit can issue a wake up call to companies that customers are not prepared to be ripped off anymore and demand energy suppliers provide a fit for purpose service. Whether it’s smart meters that actually work, customer service centres that pick up the phone to fair tariffs, an end to extortionate exit fees and just basically doing their job.”

The protest is backed by groups such as the National Pensioners Convention and 38 Degrees.

Matthew McGregor, CEO at 38 Degrees, said:

“Claiming back the cash we’ve been overcharged is a simple way for busy people to show energy companies they are sick of this broken energy system. That’s why thousands upon thousands of us are coming together to move millions of pounds straight from those companies back into the pockets of hardworking people.

“By claiming back their credit, people can claw back some much-needed cash whilst sending a clear message to energy companies. But this crisis needs proper government action too and this should be a wake up call to all political parties: from cheaper rates for those struggling the most to a proper plan to tackle energy debt, customers need help and they shouldn’t be left to take on the energy industry by themselves.”

Jonathan Bean from Fuel Poverty Action said:

“Yet again energy firms have been caught overcharging us. We demand our money back and proper action from Ofgem.”

Jan Shortt, General Secretary of the National Pensioners Convention, added:

“People have been struggling to pay their bills and it is shocking to learn that these bills may have been set far too high. Some energy suppliers will act and give credit back, most don’t so consumers need to know how to get their credit back.”

Warm This Winter has launched a guide which includes advice and guidance on how consumers can claim back their credit. The guide also includes areas consumers should watch out for, for example, it is important that people do not cancel their direct debits or else they may be moved onto a higher tariff.

ENDS

[1] USwitch data as of spring 2024.

Ofgem also reports on data, but with a lag. Ofgem data highlights the credit trends over time which show that credit balances range from £2.3bn to £5.1bn during a year. Latest data available is from 2023: https://www.ofgem.gov.uk/retail-market-indicators

Public opinion polling from Opinium who interviewed 2,000 people between 15 and 19 March 2024. Results were weighted to be representative of the UK population.

[2] Data from 38 Degrees and Warm This Winter campaign supporter databases. Total signed up to take part as at midday on 20 May 2024 was 12,908 individuals.

[3] Analysis of Ofgem customer credit data and based on a standard NatWest business savings account offering 4.25% interest.

| Quarter | Customer Credit Balance (Ofgem) | Add 4.25% interest (based on NatWest Business Saver account) | Interest earned on balance (if annual) | Adjusted for quarterly figure (i.e. previous column divided by 4) |

|---|---|---|---|---|

| 1 | £ 2,300,000,000 | £ 2,397,750,000 | £ 97,750,000 | £ 24,437,500 |

| 2 | £ 3,298,000,000 | £ 3,438,165,000 | £ 140,165,000 | £ 35,041,250 |

| 3 | £ 5,078,000,000 | £ 5,293,815,000 | £ 215,815,000 | £ 53,953,750 |

| 4 | £ 4,291,000,000 | £ 4,473,367,500 | £ 182,367,500 | £ 45,591,875 |

| Total estimated interest earned on consumer credit balances for 2023 | £ 159,024,375 | |||