Households in energy debt are being punished by a system designed to trap them in years of misery, according to new figures.

The data from the Warm This Winter campaign has revealed that two thirds (67%) of people in energy debt say it has caused them emotional distress and two-fifths (42%) say it has caused them to eat fewer hot meals in order to cut down on energy use. [1]

The figures come a month after the House of Commons Energy Security and Net Zero Committee heard how one in five (18%) of households in energy debt are turning to illegal money lenders to pay for their bills and everyday essentials. Among younger households, a quarter (24%) of under 35s and a third (32%) of customers aged 35-44 are turning to illegal money lending.

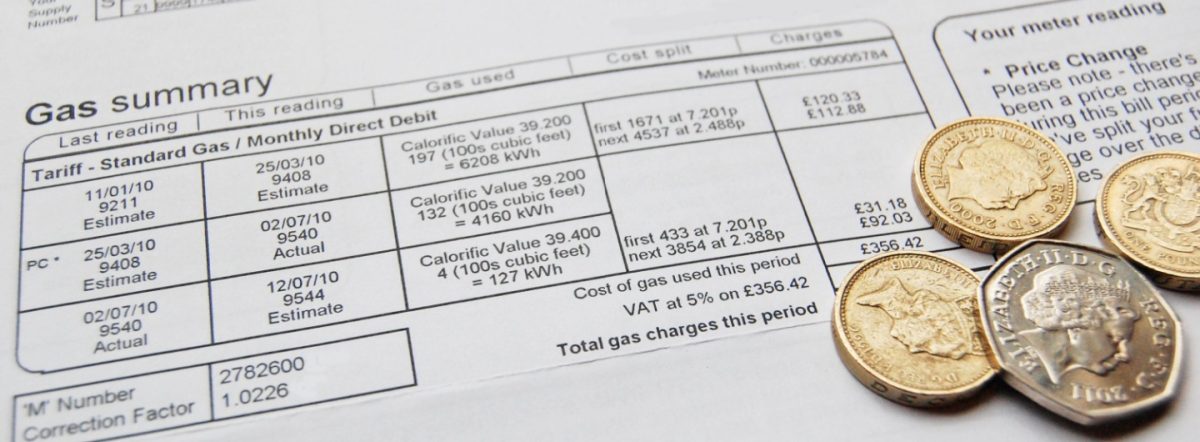

For many in energy debt, energy firms will suggest moving to a prepayment meter (PPM), which enables customers to pay off their debt every time they top up their meter. But the research indicates that the suffering of households in debt on prepayment meters is even worse than for those on direct debit.

Levels of emotional distress increase among PPM customers in debt (93% on PPM / 58% on direct debit) as do the numbers reducing hot meals (60% on PPM / 38% on DD). And the numbers turning to illegal money lending are also significantly higher for PPM customers (36% PPM / 13% DD).

The respondents to the research shared their harrowing stories anonymously with researchers [2]. A prepayment meter customer wrote:

“My energy debt was the reason [I moved] from credited monthly bills towards prepayment meter. It [has caused the] cutting off electricity so many times. It causes disruption and, in my opinion, barely legal. I think that law should protect people who suffer from financial hardship in the context of electricity bills.”

Another respondent said:

“I think it is disgraceful during a cost of living crisis and having severe health problems that the energy companies have been allowed to put up their standing charges so if I do not use any gas or electricity I will pay £390 a year. The price of the electricity and gas is disgraceful and even though the energy firms say they are there to help they send threatening letters stating they will force entry and install a prepayment meter to peoples households, plus if you are late paying they charge £10 then £35 etc.”

One pensioner commented:

“I sit in the house with the lights out and only have my heating on for an hour. What else can I do? My account should not be in debt for the amount I use. It’s disgusting and they are making millions in profits.”

Meanwhile one participant in the research commented on the toll it is taking:

“I work hard and always have done, facing the situation from the energy crisis has left me with little to no money to be able to afford other essentials like clothing. It is incredibly depressing sometimes and not conducive to good health.”

A spokesperson for the End Fuel Poverty Coalition commented:

“Millions of households have fallen into energy debt due to the record high prices. The average household has had to find £2,500 in the last few years just to keep their energy usage where it was. When combined with the ongoing cost of living crisis, this is a figure well beyond people’s means.

“While the energy industry has pocketed the profits, struggling families have been abandoned.

“Energy debt is forcing households to wake up in the morning scared of the consequences of using electricity or gas. It’s time to end the punishment of energy debt.

Campaigners have called for a universal, consistent, nationwide, debt matching programme funded by the £1.3bn customers are paying through bills for energy debt costs this year.

Experts have also recommended a ban on energy firms from selling on debt to debt collectors, better regulation of energy debt with energy debt and debt collection agencies used by energy firms to be subject to Financial Conduct Authority rules and more training for energy firms’ staff in recognising illegal money lending.

Warm This Winter spokesperson Fiona Waters said:

“The next Government will need to act quickly after the election to end energy debt, protect households from the energy market, bring down bills for good, improve housing standards and make Britain a clean energy superpower. All we have had so far from politicians are warm words that they understand the crisis. What we need are concrete promises of action.”

Jonathan Bean from Fuel Poverty Action said:

“A cruel combination of energy debt, prepayment meters and high standing charges is making life a misery for millions of us.”

ENDS

[1] Research was conducted among 500 people across the UK living with energy debt (previous nationally representative polling among 2,000 people revealed that 15% are experiencing energy debt). The interviews among those in debt were conducted online by Sapio Research between April and May 2024 using an email invitation and an online survey.

Results of any sample are subject to sampling variation. The magnitude of the variation is measurable and is affected by the number of interviews and the level of the percentages expressing the results. In this particular study, the chances are 95 in 100 that a survey result does not vary, plus or minus, by more than 4.4 percentage points from the result that would be obtained if interviews had been conducted with all persons in the universe represented by the sample. Sample was selected from Online partner panels.

Key statistics national variations (NI samples too small to be representative):

|

All UK |

Scotland only |

Wales only |

| Use of illegal money lending |

18% |

13% |

17% |

| Causes emotional distress |

67% |

67% |

78% |

| Cuts down on hot meals |

42% |

30% |

57% |

Debt and disability

– 21% of people with a disability or long term illness and who are in energy debt have turned to illegal money lenders (18% of those in debt more generally)

– 52% of people with a disability or long term illness and who are in energy debt have cut back on hot meals (43% of those in debt more generally)

– 74% of people with a disability or long term illness and who are in energy debt say the debt has caused emotional distress (67% of those in debt more generally)

[2] Respondents to Q9: Line 130, Line 19, Line 50, Line 60, Line 37, Line 189.