The country will no longer be able to meet heating demand using only domestically extracted gas by 2027, even if new fields are approved, according to new analysis of official North Sea production data.

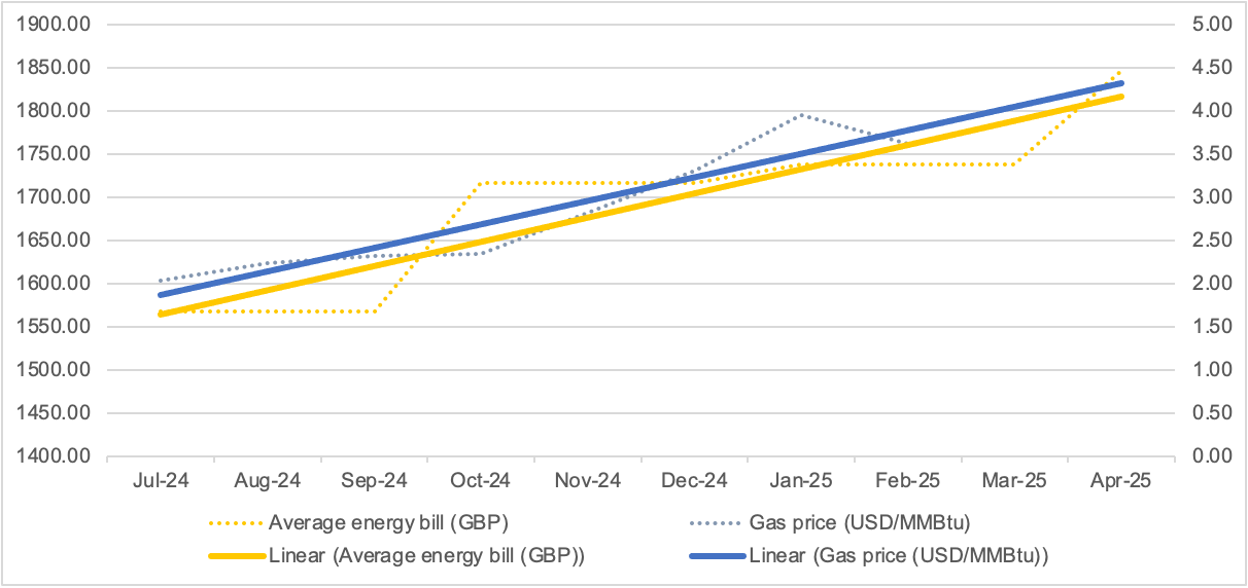

Official data shows that by 2027, UK gas production is set to fall short of what’s needed just to heat our homes, which currently accounts for 38% of UK gas use. In just two years’ time, more than two-thirds of the UK’s gas needs will be dependent on imports. [1]

The figures provide a clear warning that the North Sea is running out of gas.

Even if new fields are approved, it won’t be enough to reverse the trend and the UK would still be almost entirely (94%) reliant on imports by 2050.

Experts say this has nothing to do with politics or policy — it’s the geological reality after half a century of drilling. Of all the gas estimated to have been in the North Sea basin, just 14% remains commercially viable according to official statistics. [2]

Even the lobbyists working for the North Sea industry admit that the financial viability of any additional extraction is “beyond realistic assumptions” and would only be possible with “major industry change.” [3]

Gas extracted from the North Sea is usually sold on international markets, which also leaves UK consumers subject to volatile prices. But even if the UK took the drastic step of only supplying its national needs, the trend data shows that at current levels of UK demand, existing fields hold just over three years of gas. New fields would add less than half a year.

A spokesperson for the End Fuel Poverty Coalition commented:

“The geological reality is that the North Sea basin is dying and there are limited levels of gas for home heating left. The country is simply running out of gas and no amount of new drilling will stop Britain’s deepening dependency on foreign gas.

“The sooner households are supported to move to alternative heating and cooking systems the better.

“But what’s worse right now is that some politicians are dangerously misleading the public by overstating the North Sea’s continuing role in UK energy security.”

Recent polling by Uplift found that around two-fifths (41%) of the public mistakenly believe that there is enough gas left to significantly reduce or eliminate gas imports. [4]

Donald Trump recently claimed there’s a “century of drilling” left in the North Sea. Nigel Farage says the UK should be “self-sufficient” in gas and Tory leader Kemi Badenoch has alleged that gas will power Britain “for generations”.

Tessa Khan, executive director at Uplift commented: “Politicians are deliberately and dangerously misleading the public into thinking this country has a secure energy supply in the North Sea, when it is clear we do not.

“The hard truth is that, after 60 years of drilling, the UK has burned most of its gas and no amount of new drilling will change that. Our reliance on foreign gas is going to increase unless and until we shift to renewable energy, like wind, which we’re lucky to have in abundance.

“We cannot afford another decade of delay. Quite apart from the extra costs that households and businesses will incur from continuing to rely on volatile fossil fuels, and the damage they are causing to our climate, the UK’s energy workers need jobs that have a secure future.”

Polling previously found that two-thirds (67%) of the country are already concerned about the impact of the UK’s reliance on oil and gas.

ENDS

[1] Methodology and assumptions for analysis undertaken by the research team at Uplift on behalf of the End Fuel Poverty Coalition.

Residential gas demand is based on estimates from the Climate Change Committee’s Seventh Carbon Budget Balanced Net Zero Pathway (BNZP). If action is not taken to decarbonise in line with the CCC’s BNZP, then the CCC’s Seventh Carbon Budget baseline scenario estimates for residential gas demand suggest that this inflection point will take place in 2026, instead of 2027.

NSTA production projections (March 2025) were used by researchers at Uplift to estimate gas import dependency in the UK through to 2050 under the CCC’s BNZP.

The nation’s gas import dependency is set to rise from 55% today to 68% in 2030, 85% in 2040, and 94% in 2050 — even if new fields like Rosebank, whose reserves are primarily oil destined for export, are given the green light. Even if new licenses were to be approved, the maximum they could reduce import dependency in any given year is again just 2%, meaning that gas import dependency would still soar to 83% in 2040 and 92% in 2050.

On an annual basis, the amounts of gas expected to be produced within already producing or sanctioned UKCS fields were compared against the amounts of gas required to meet UK demand under the Climate Change Committee’s Balanced Net Zero Pathway (as published within the NSTA’s projections).

This established what proportion of UK gas demand could be met by UKCS gas production without the development of new projects, with the remainder needing to be met by gas imports – thus providing a baseline estimate of UK gas import dependency.

This analysis assumes that all gas produced in the UK is used domestically, as estimates for the exportation rates of gas produced in the UKCS are unavailable. However, there is no guarantee that gas produced from UK fields will be used within the UK, and so this is likely to overestimate the amount of gas that will be used to meet UK demand.

As such, this analysis provides the most optimistic estimates of UK gas import dependency. In reality, gas import dependency levels will likely be higher.

To estimate how import dependency could change with the development of new North Sea fields, gas import dependency was recalculated accounting for the NSTA’s production projections for gas with the development of undeveloped discoveries.

To analyse the potential impacts of the Rosebank and Jackdaw projects, gas import dependency was recalculated accounting for the annual gas production estimates published in the Rosebank and Jackdaw Environmental Statements.

Production estimates from the Rosebank and Jackdaw Environment Statements provide the highest range of gas expected to be produced from these fields, which are necessary to assess the worst case environmental impacts. However, the mid case production profiles, which provide the most likely range for production from these fields, are lower. As such, the impacts of the Rosebank and Jackdaw fields on UK gas import dependency will be overstated.

[2] The UK has already extracted 86% of recoverable gas from the UKCS, leaving just 14%, most of which lies within existing fields (8% in existing fields, 1% in new fields, 2% in licensed but undeveloped, and the rest in unlicensed acreage). Based on data in: https://www.nstauthority.co.uk/media/vtjkyqnf/uk-reserves-and-resources-report-as-at-end-2023.pdf

Expert commentary includes:

- Andy Samuel, former head of the regulator, North Sea Transition Authority, has said “it’s unlikely, given [the North Sea is] a mature basin and the geology is well-known, that we’re suddenly going to have a situation where we are significantly growing production again.”

- Former BP chief Lord Browne has said the decision by the previous government to expand North Sea drilling is “not going to make any difference” to Britain’s energy security and is “symbolic”.

[3] Westwood Global Energy Group “Potential of the UKCS under different scenarios” summary report on behalf of OEUK (June, 2025), p15.

[4] Polling commissioned by Uplift and conducted by Opinium in May 2025, with a representative sample of 2,050 UK adults.