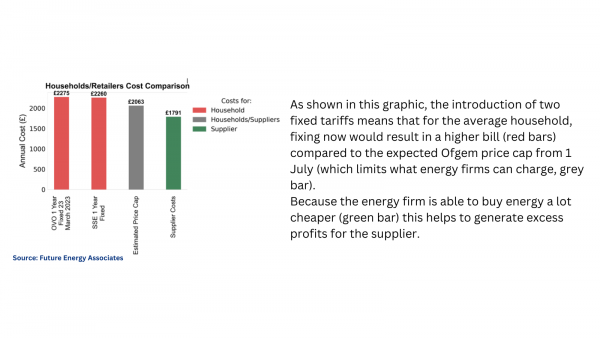

Research from Future Energy Associates has estimated that two energy firms that have offered new fixed tariffs are set to rake in an average of £484 and £469 respectively in profit on each customer. [1]

The profits will be driven by energy firms buying energy at a fixed cost and selling it to customers at a level below the current Energy Price Guarantee (EPG), but above the likely level of energy bills when the Ofgem price cap comes back into force for consumers from 1 July.

Analysts predict that based on an average household bill under the expected Ofgem Price Cap of £2,064 [2], customers who switch to the deal will lose out by £212 on the Ovo fix or £197 on the SSE offer compared to sticking to the Government’s EPG rate and then moving to a variable tariff governed by the Ofgem price cap from 1 July. [3]

A spokesperson for the End Fuel Poverty Coalition which is part of the Warm This Winter campaign, commented:

“The Wild West of the energy market is back, with energy firms trying to make a quick buck from people’s confusion with their energy bills.

“They are playing on the cost of living crisis to try and tempt customers onto a deal that offers security, but appears to come at a very high price to their pocket. People continue to be penalised by Britain’s broken energy system.”

Clem Atwood from Future Energy Associates, commented:

“After record breaking power prices of last winter we are now seeing forward electricity prices come down, meaning suppliers are now paying less for power than accounted for by Ofgem’s price cap.

“While costs continue to come down, suppliers will look to exploit consumer desires to move onto lower rate tariffs by trying to fix customers at close to current rates. Our analysis of costs shows that recent fixed tariffs are likely to make suppliers around 20% profit, whilst fixing customers at unit rates above the forecasted Ofgem price cap.”

Tessa Khan, executive director of Uplift, said:

“Energy companies are addicted to trying to make eye-watering profits at every turn. Having raked in billions in a matter of months from both government support schemes and the pain felt by businesses, they are now starting to turn again to our energy bills.

“It is yet another sign that the government needs to step in and fix the UK’s broken energy system. We need a complete overhaul of the system, including switching to cheaper renewables and funding for insulation, not a return to the bad old days of profiteering energy firms ripping us off.”

Jacky Peacock, Head of Policy at Advice for Renters, commented:

“Many of the families we assist have restricted their energy use to two hours a day and may well think that the fixed price guarantee will result in a saving. We’ll be doing our best to warn them to avoid such offers which are little short of scams.”

Ruth London from Fuel Poverty Action added:

“After all the misery suppliers have inflicted on their customers – unpayable bills, break-ins to impose unwanted prepayment meters, ill health, and cold, dark homes – is this a time for dirty tricks? The suppliers are playing on people’s fears and when we can’t pay their inflated prices we will be blamed and punished for going into debt.”

Notes to Editors

The content of this story is provided based on the assumptions below and the analysis by energy data experts. It should not be taken as formal financial advice. The prices of energy are correct at the time of analysis and may change considerably from the predictions made here.

[1] Tariffs examined: Ovo 1 year fix and SSE 1 Year Fix v28. Supplier Profits Calculated Utilising Comprehensive Methodology from Future Energy Associates (FEA), outlined below. In order to evaluate supplier profits, a comprehensive methodology was employed, which encompassed several steps as detailed below:

-

Firstly, the FEA collected electricity forward prices for a 12-month period, which is the level an energy supplier could be expected to pay for the energy they then re-sell to domestic customers.

-

Subsequently, electricity wholesale prices were calculated for each quarter, with both seasonal fluctuations and peak/base prices taken into consideration.

-

These wholesale prices were adjusted according to each of the non-wholesale price components present in a typical household bill. The analysis differentiated between components that adapt to decreasing wholesale prices and those that remain fixed, irrespective of wholesale price fluctuations.

-

Following this, electricity retail price unit rates were calculated by multiplying the annual Ofgem consumption values and standing charge forecasts. This process yielded the electricity portion of the household bill.

-

With respect to gas, the same difference ratio between gas and electricity prices, as derived from Cornwall Insight’s price cap forecasts, was assumed.

-

Lastly, gas and electricity prices were combined to determine the annual household energy bills, thereby allowing for a comprehensive assessment of supplier profits.

A chart is available which shows that, for the average household, fixing now would result in a higher bill. This model assumes that the whole difference between the cost to the consumer and the cost to the supplier is profit. This assumption is a fair one as Ofgem and suppliers regularly correspond on the costs incurred by suppliers in delivering supply to consumers, which Ofgem then reflects every quarter in its price cap calculations (and therefore has been reflected in the operating cost assumptions made by this model). This process ensures energy firms should not be subject to significant operating losses on providing domestic supply.

This is summarised in the table below.

This is summarised in the table below.

|

OVO, SSE Case Study (all numbers are GBP) |

|||

|

Tariff Names |

OVO 1 Year Fixed 23 March 2023 |

SSE 1 Year Fixed v38 |

|

|

Annual Costs to households £ |

2275 |

2260 |

|

|

Ofgem Price Caps / EPG |

Forecasted Average Ofgem Price Cap (01/04/23 – 30/0304/24) |

See note [2] |

|

|

Annual Costs to households £ |

2063 |

||

|

Tariff Names |

OVO 1 Year Fixed 23 March 2023 |

SSE 1 Year Fixed v38 |

Notes |

|

Annual Excess Costs To Households |

212 |

197 |

I.e. difference between fixed tariff and average Ofgem Price Cap |

|

Annual Supplier Costs of buying energy |

1791 |

1791 |

Based on FEA calculations on forward energy prices when fixed tariffs announced. |

|

Annual Supplier Profits £ |

484 |

469 |

See above for assumptions. |

|

Annual Profits % |

21.27% |

20.75% |

As a percentage of the cost a consumer could be paying on the Ofgem Price Cap. |

[2] Based on EPG, Ofgem Price Cap and latest Cornwall Insight predictions and adjusted by FEA to take into account a full year of price cap changes and the Energy Price Guarantee operating for part of the year.

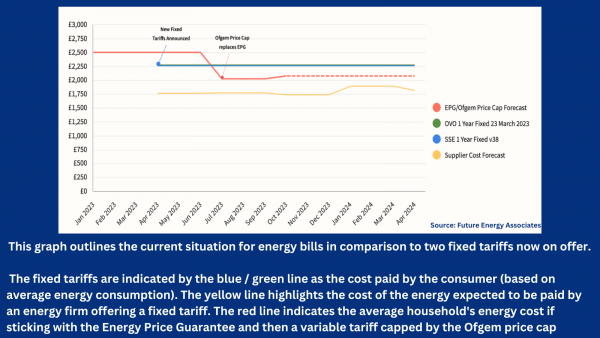

[3] A chart is available to outline the current situation for energy bills in comparison to the fixed tariffs now on offer.